I guess all those people who eventually bought into the last crypto dip just to find out the dip keeps dipping. I expected a lot of pain last year. I expected a $25K Bitcoin, but I didn’t expect that many liquidations of institutional money. Looks like we could easily see another 50% drop due to the negative sentiments and event that surrounds bitcoin and the entire crypto world.

In this article, I’m going to give you seven reasons why you should not buy the dip now @ $19k Bitcoin because the dip might keep dipping. Here we go.

1. Inflation

From the FOMC meeting, the FED reportedly hikes the rate of inflation which is currently affecting the crypto market negatively. At present, it is generally expected that the Fed’s interest rate meeting on June 15 will still increase by 50 basis points, and the probability of raising interest rates by 75 basis points is nearly 20%.

Barclays was the first major Wall Street firm to expect the Fed to raise rates by 75 basis points. Some traders see a 50% chance the Fed will raise rates by 75 basis points in July, while Barclays expects that amount to be raised as soon as next week.

Powell’s remarks at the press conference are also worth watching, last month Powell made it clear that he was not actively considering a 75 basis point rate hike, and his rhetoric may change amid unexpectedly high inflation.

2. Warmongering Between NATO and Russia

It’s no news that Russia invaded Ukraine due to rumors that they intend to join NATO which led to the outburst of war that’s currently affecting the economy while the Russian currency (Ruble) is having a boost. And we observed Ukraine is using cryptocurrency as means of donation and funding for the war, which in turns would create selling pressures.

3. (still) Overleveraged Cryptomaniacs

Cryptomaniac over-leveraged activities also pose great risk and FUD in the crypto ecosystems just as in the Do Kwon Luna crash wiping away billions of dollars from the crypto market cap, Celsius, 3AC liquidation margin call and others. All create negative sentiments and cause sell pressures. In addition, the founder of FTX Sam Bankman warns that some crypto exchanges are already secretely Insolvent.

4. Unclear Situation of Regulation

The government is still debating on whether or not to regulate cryptocurrency activities, and also place higher taxes on crypto dealings which also causes investors or traders to back off a bit. Until the regulation topic mellows, the crypto market is prone to continue witnessing a high level of FUD which in turn drives the bear market.

5. Fear and Greed Index

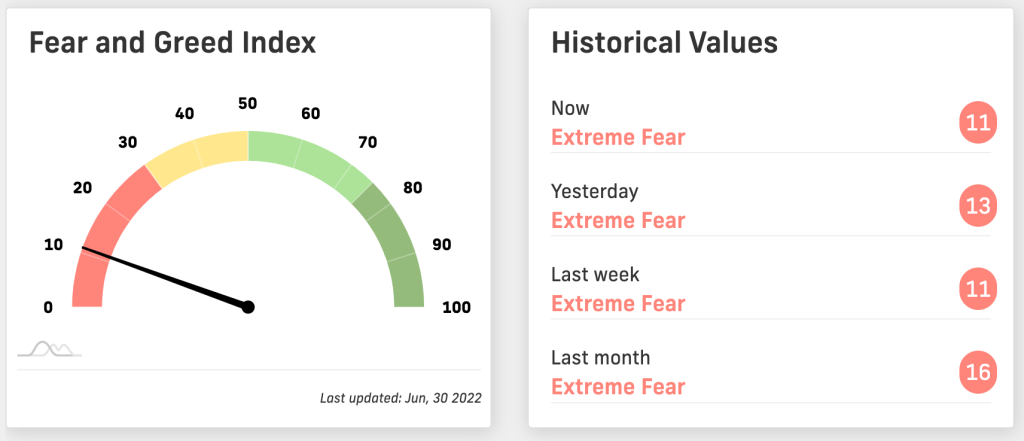

The fear and greed index is on the lowest score 11 (extreme fear) which signifies that the bear is still very powerful, in other words, people are scared of the market (not buying, or ready to buy). And until the fear and greed score begins to rise towards the green side of the chart, it’s not advisable to buy the dip.

6. Crypto Winter

Crypto Winter signifies the seasons where bears are kings over bulls in the crypto market, and of course, most crypto winter takes years at times before the market recovers. Though we can’t fully know when we are in a crypto winter but due to happenings and statistics from the Bitcoin Yearly Candlestick we can predict that we’re in another Crypto winter after the very first one which occurred in 2018. But then, we can only predict and not fully know when the crypto winter will end. So don’t buy the crypto dip now, maybe because this is just the beginning of the winter to avoid the forthcoming dips.

7. Bitcoin Yearly Candlestick Metrics

From analysis from the Bitcoin Yearly candlestick, the metric has made us understand that there’s always a sudden crypto market crash every four years after, and from statistics, 2022 happens to be the fourth year after, and maybe that’s why we are experiencing a market crash. Hence, don’t be in a haste to buy the dip, because we are still in 2022 to avoid the dipping dip.